Investment Advisor

Invest with confidence to help your mosque, school, endowment or foundation progress toward its long-term goals

Allied Asset Advisors is an SEC-registered investment advisor, founded in 2000. Our team works tirelessly to provide investment services to individuals, families, and organizations alike.

We also offer portfolio management services to nonprofit organizations, endowments, businesses and other organizations. We help establish financial sustainability, allowing you to continue your mission to benefit often underserved communities.

While most investors can be served by Iman Fund (IMANX), we also offer separately managed portfolios that can be customized to meet your organization’s Investment Policy and objectives.

Nonprofits | Understanding Priorities

Allied Asset Advisors (AAA) genuinely understands the responsibilities and priorities of nonprofits. Sustained by our faith, we work with you to put beliefs into action, investing for the long-term success of your organization and its members.

Mosques, schools, endowments and foundations can benefit from the expertise our team brings from the leadership positions they hold with many non-profits. In addition, AAA is a wholly-owned subsidiary of the North American Islamic Trust (NAIT), the nation’s original and leading Islamic trust/endowment (Waqf) serving the Muslim community.

In Partnership

As your strategic partner we’ll listen first. Then, we’ll work with you to formulate a unique Investment Policy Statement that considers your values, long- and short-term goals, operating budget, cash flow needs, and tax status.

In addition to investment management, as needed, we can provide:

- Support for board governance.

- Help analyze capital planning or fund raising initiatives.

- Prepare hypothetical scenarios for drawdown management.

- Educate your board about weathering different market scenarios.

- Facilitate stock donations and donor advised funds, and more.

- Our goal is to deliver open, transparent investment management along with excellent service.

Designed for Your Organization

Guided by our Investment Policy, your investment portfolio will be customized to your organization’s risk tolerance and financial goals. We can incorporate Environmental, Social, & Governance (ESG) and/or Socially Responsible Investing (SRI) principles, as desired. Our objectives are to:

- Achieve long-term equity-like returns with less volatility

- Minimize frequency and magnitude of losses in down markets

- Maintain consistently broad diversification with regular rebalancing

- Adhere to Islamic investing principles

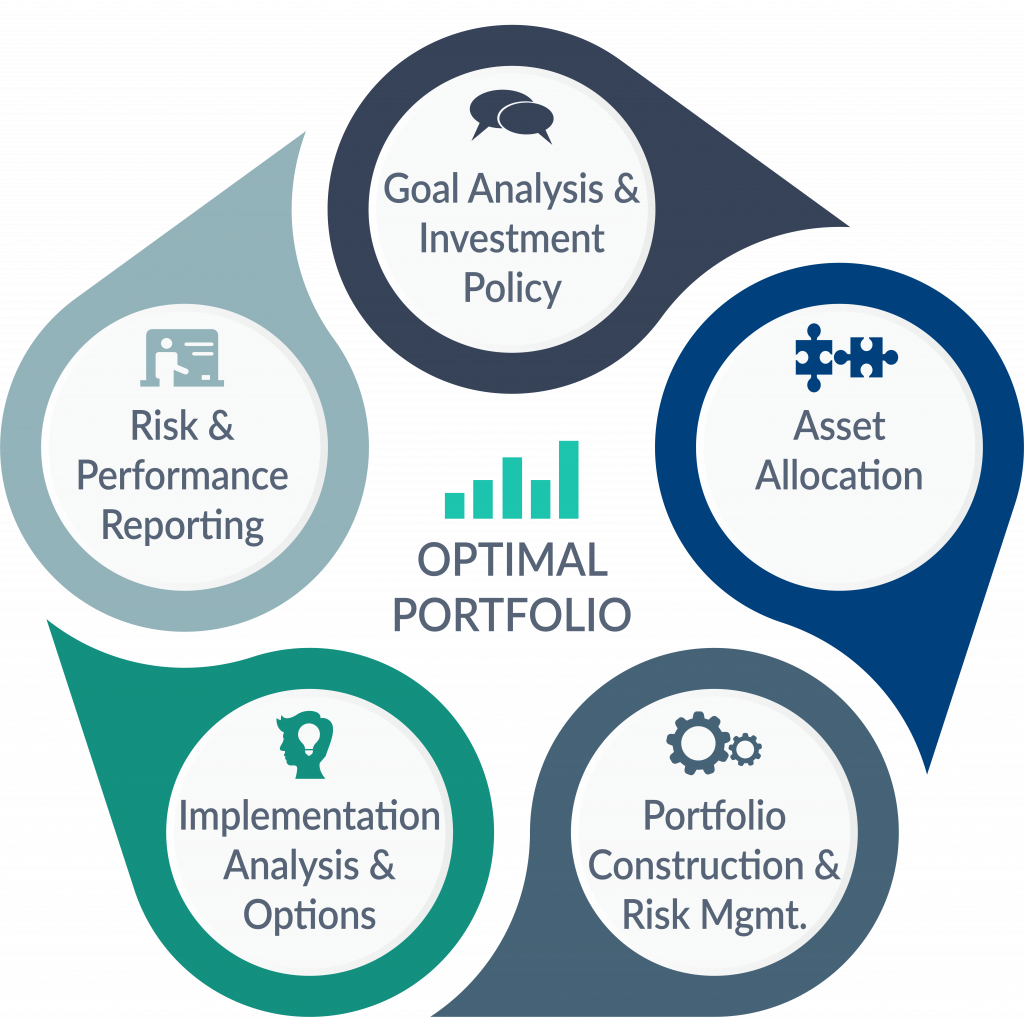

Seeking Optimal Outcomes

- We meet with you to understand your current situation and

goals to create your Investment Policy Statement - Design a specific asset allocation to fit your objectives

- Construct a portfolio with appropriate mutual funds,

ETFs, and stocks across all market sizes, to include developed

and emerging global equities, sukuks and real estate - Assess our strategic decisions, evaluating the portfolio for a

variety of market conditions - Report regularly on risk management and performance

The Value of Experience

Since 2000, as advisor to a Shari’ah compliant mutual fund, Allied Asset Advisors has dedicated itself to helping the Muslim community be financially responsible in pursuing their long-term goals.

We View Allocation as the Key

Each asset class brings a vital dimension to your portfolio because each has the potential to behave differently than the others from year to year. It is impossible to predict the future, so we don’t attempt it. This is why multi-asset diversification plays a significant role in the success of your portfolio. We refer to this diversity as low correlation, meaning that each of the asset classes chosen for your portfolio generally react differently to varying market conditions and with respect to one another.

Call Mohamad Nasir, Investment Consultant, to learn more at (630) 789-0453.